- Financial sector marketing tools

- Improve brand awareness and visibility of your bank on social media

- Generate leads from potential clients with giveaways and prizes

- Photo contests organized by financial institutions: generated user-generated content and engagement

- Promote banking apps with incentives and prizes

- Gamification: entertaining promotions for clients of your bank, credit union or insurance company

Financial sector marketing tools

The traditional marketing mix is still relevant, although it has definitely evolved. One of the four Ps is promotion – still essential, covering aspects such as incentives, advertising, public relations, and direct marketing. All these individual fields have been highly digitalized as the professional behind financial institutions understood the importance of online presence. Interestingly, many of them made digital promotions, contests, and giveaways a permanent part of their online strategy, as they have proven over and over again to be successful tactics when it comes to cross-sales and capturing new clients. This is because direct marketing is all about specific campaigns that trigger customers to take action.

Marketing actions conducted by financial institutions and banks finally put the customers in the center; it’s now all about creating and fostering customer relationships, as well as enhancing customer loyalty. The financial sector companies now focus on generating interaction with their customers – giving likes, submitting contact information, and playing branded games… it all counts!

Not sure if you’re ready to buy this idea? Let us show you some successful examples from other financial institutions that have already implemented innovative marketing actions. Get ready for some inspiration!

We’re about to cover:

- Campaigns that improve brand awareness and visibility on social media

- Giveaways and prizes that generate leads for financial services companies

- Contests that impact brand affinity

- Ways to promote banking apps

- Gamification and entertaining campaigns that entertain and boost brand loyalty

Improve brand awareness and visibility of your bank on social media

One of the most common objectives of financial institutions is to be popular among their target audience. Social media is where your audience is. It’s also a fantastic place to stay in touch with your customers and inform them about your latest news. But social media channels are also useful when it comes to attracting future customers. One tactic that never fails is social media giveaways.

As a banking entity, you must ensure that your giveaway complies with online promotion regulations established by the country, as well as the social media network. Make sure you share your terms and conditions with the participants so that they can find all the needed information. Running an Instagram Giveaway? Add a direct link to your giveaway T&Cs to your Link in Bio, the way Keytrade Bank did.

Easypromos offers a free terms and conditions tool! Edit your T&Cs and share them online as a link! The Easypromos T&C tool allows you to make changes to your terms and conditions without having to upload any extra files!

Social media giveaways are based on customer interactions, which lead to increased brand visibility and presence online. Participants are often asked to mention a couple of friends in the comments and that highly increases brand awareness. The prizes that you raffle will also impact how your audience views your brand – the more attractive the prize, the more loyalty it’ll generate!

Free tickets to popular events or shows, as well as electronic gadgets, work well – because everyone enjoys a new toy or a nice day out, especially for free! BNL Insurance has already turned to social media to grab the attention of potential customers.

Apart from showcasing the prize, they also managed to add all participation requirements to the image.

Generate leads from potential clients with giveaways and prizes

Another important objective for banks and credit unions is to collect contact information from potential customers so that direct communications can start. Social media giveaways work really well but their only disadvantage is that they don’t generate leads. So if you’re looking to maximize lead generation you should take a look at Entry Form Giveaways that comply with GDPR regulations, clearly present Privacy Policy and terms and conditions, as well as opt-in boxes for marketing communications.

Let’s take a look at the following examples from financial entities. In the first example, you can clearly see how Unicaja approached their lead generation objectives; in order to attract more participants, they raffled a popular electric book reader. All interested participants filled out a registration form where they shared their basic contact information. This way, Unicaja could initially qualify the leads and decide which users should be contacted by the bank.

US Bank has a solid marketing strategy in place as they regularly run different types of promotions and sweepstakes. Some of them are aimed at the general public, while others reward only existing customers of US Bank. Take a look at the following examples to see how easy it is to convert website visitors into qualified leads! Anonymous website visitors leave their contact detail for a chance to win cash prizes, while US Bank nourishes their database.

Photo contests organized by financial institutions: generated user-generated content and engagement

Looking to generate engagement and brand visibility? It’s time for a photo contest organized by your financial institution! Contests do consume more time and require more dedication but your audience won’t be discouraged if the prize is good enough!

Have you ever wondered why photo contests are so popular with banks, credit unions or insurance companies? The answer is simple; apart from collecting user-generated content you also create new brand ambassadors and authenticity for your company.

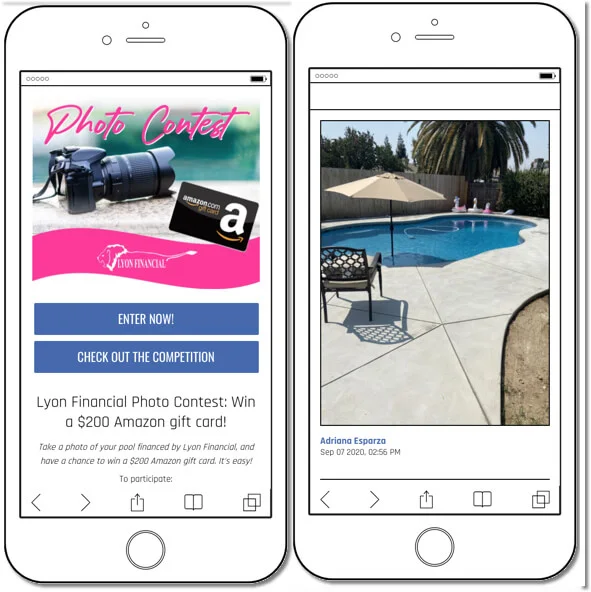

Take a look at the photo competition organized by Lyon Financial – a swimming pool loan company. They looked to promote their services in a different way so instead of sharing professional photos, they asked their customers to share snaps of their swimming pools for a chance to win a $200 Amazon gift card.

Apart from collecting UGC they also generated engagement.

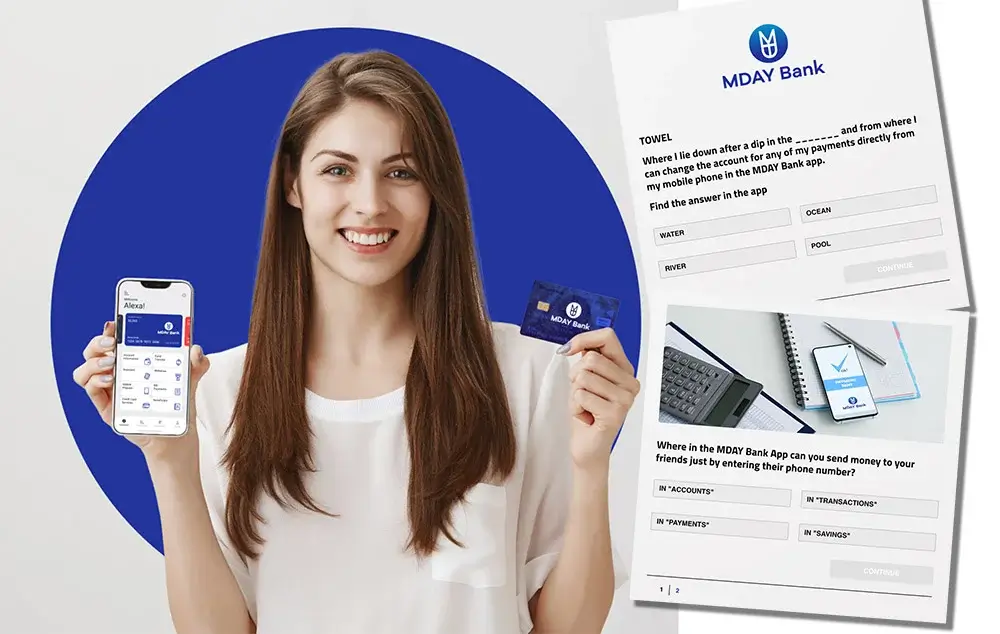

Promote banking apps with incentives and prizes

As the banking sector started to become more digitalized, companies had to come up with new technologies and applications for their customers. Mobile banking apps have been making our lives easier for some time now and to a point that we no longer have to step a foot in an actual bank. However, some people are not so used to using such tools, which means that banks are now on the lookout for effective ways to promote their mobile applications and encourage their customers to use them more often.

Nations Trust Bank raffled three smartphones among all participants that downloaded the new mobile app! Of course, not every company can afford this kind of prize (but if you do, go for it!) but don’t worry, there are other ways to drive your customers to get your new banking app on their devices. You can raffle pre-paid credit cards, free insurance, or cash!

Would you like to find out more about increasing your mobile app downloads? Head to our blog post dedicated to increasing app downloads with promotions and games.

Gamification: entertaining promotions for clients of your bank, credit union or insurance company

Sweepstakes and contests are well-known tools for financial sector marketing, however, there are still not so many banks, credit unions or insurance companies that opt for gamification. This is something that we expect to change soon as gamification not only attracts attention but also generates positive relationships between the organization and users.

Here you can see a few different examples of gamified promotions that financial institutions can use to attract new customers and retain the existing ones.

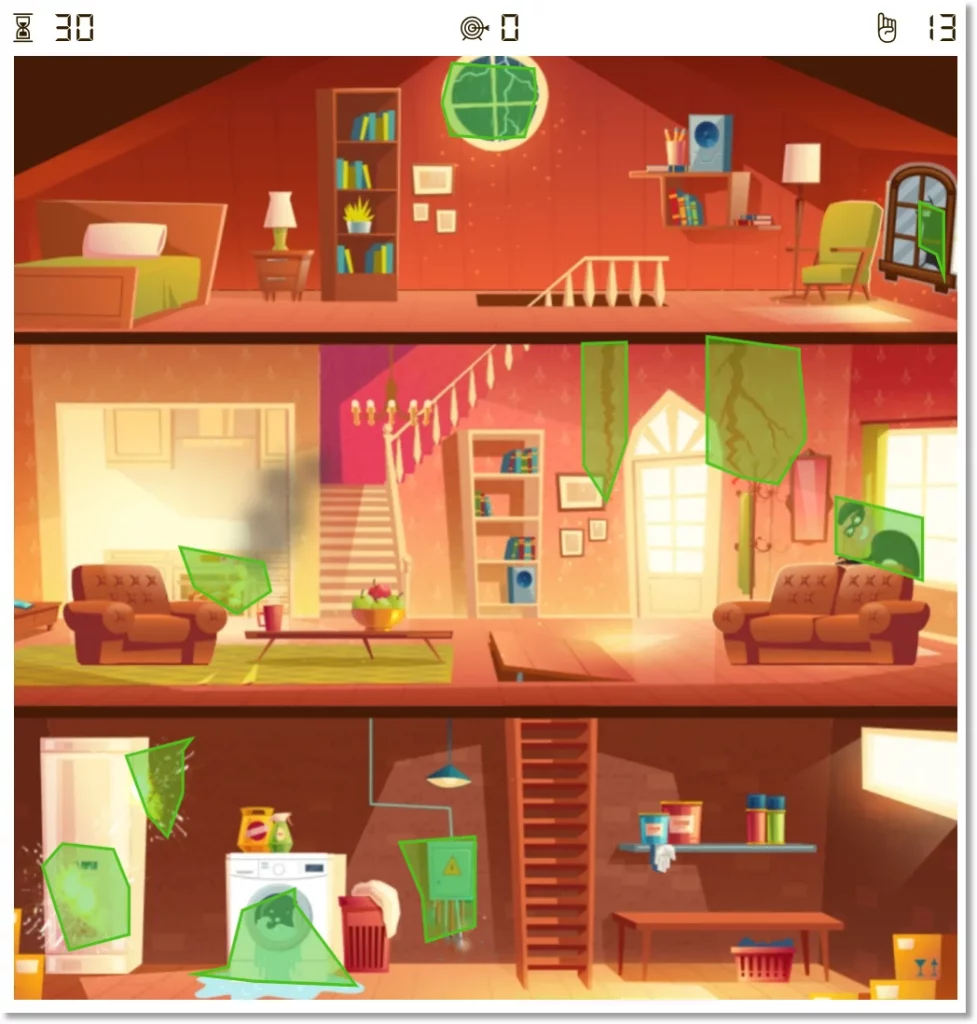

Hidden Objects games

Mini-games are great when it comes to generating engagement and boosting brand or product awareness. Gamification is especially useful when you want to entertain or educate your audience, also when sharing information about your products. Take a look at the following example from an insurance company that was highlighting the importance of having a building and house insurance. They invited participants to look for causes of damages that can happen to a building. One lucky participant won a tablet, while the brand got to promote one of its products.

Questionnaires and quizzes

One of the most popular and classic ways to engage the audience is through quizzes. Questionnaires rapidly adapted to the digital world with many platforms that now allow online users to create their own quizzes without the need for programming skills. The Easypromos quiz apps stand out from the crowd as they allow you to draw random winners from all the users that participate in your quiz.

Here’s an example of a quiz that can be launched by any financial institution. In this specific quiz, users answer two simple questions for a chance to win a pre-paid credit card.

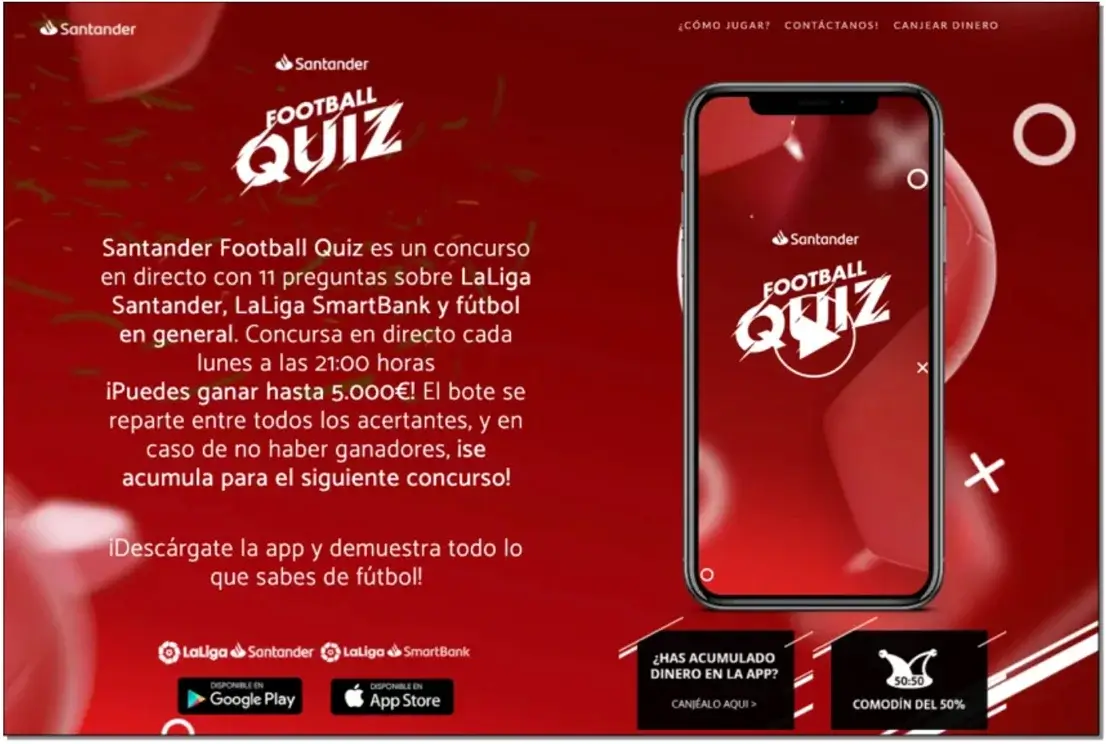

Another example comes from Santander. In this case, the bank organized a special quiz for football fans. Every Monday, they published new questions in their mobile banking app, as the quiz was for Santander customers only, as the bank looked for a way to engage and reward their clients.

Encourage creativity with the Easypromos app

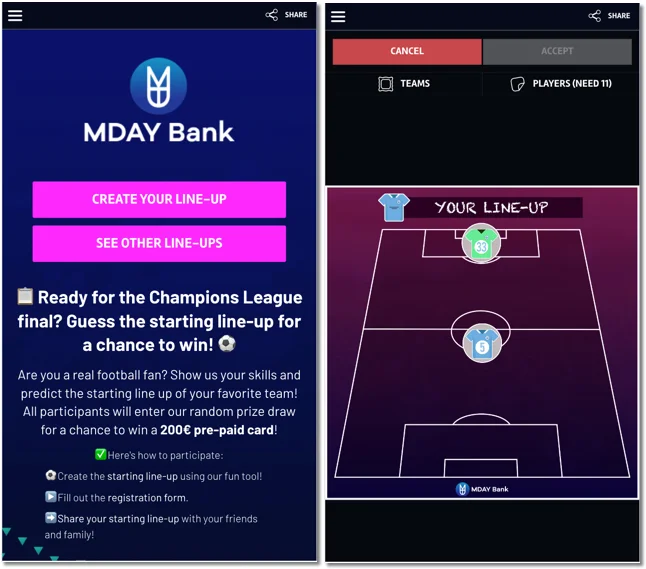

The banking world might not stand out for creativity but it’s no surprise that innovative ideas are essential for the growth of banks and other financial entities. Other sectors regularly launch creative contests, for example, looking for a new logo or packaging design. Of course, this kind of promotion would not succeed in the financial sector but creativity can come in handy. Take a look at the following example launched with the Easypromos Scenes application. The organizing brand asked users to create their ideal football line-up right in time for EURO2020.

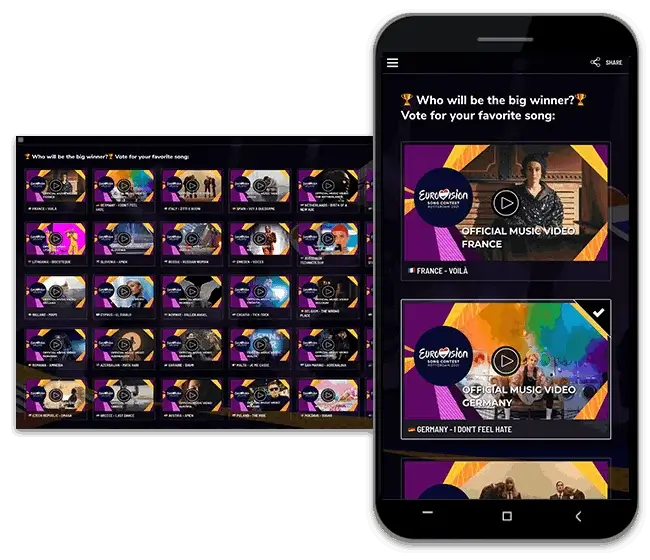

Online voting contests to learn more about your audience

A great example is the following Pick Your Favorite DEMO. MDAY Bank took advantage of Eurovision – a popular event followed by an important part of the society. MDAY knew that all users that participated in their voting contest enjoy music and that’s a piece of important information for the organizing brand, as they could then launch a special giveaway to raffle tickets to a music festival or concert. This would be a great tactic if the organizer is looking to generate and maintain high brand engagement because what’s better than a giveaway for a prize that the participants would really enjoy?

Puzzles and games that entertain, engage and retain

Brands are often looking for ways to entertain and engage their audience, and rightfully so! Positive experiences lead to stronger customer relationships and therefore better satisfaction. Entertaining apps like branded mini-games allow brands to now only provide fun experiences but also generate engagement and new sales prospects.

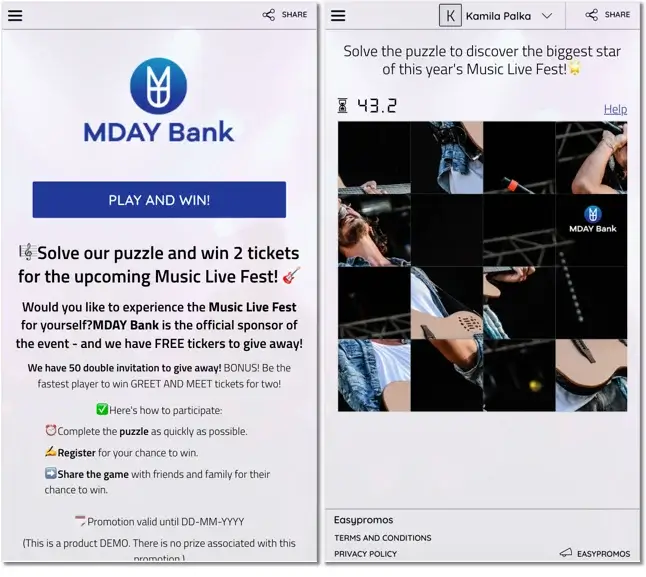

The MDAY Puzzle DEMO shows us perfectly how to do it. Would you like to collect leads from a specific location? This is when prizes can really help. You can launch a fun Puzzle and raffle tickets to a popular event in the location of your interest. Don’t forget to customize the game application with your corporate image to work on brand recognition.

Games are just like any other online promotions – it’s important to decide on the main objective of your campaign and the target audience before you launch the campaign. It will help you come up with a prize and dynamic most adequate for your goal and target.

Are you looking to change the marketing strategy of your bank or other financial institution? We hope that these ideas have shed some light on more innovative ways of generating engagement and attracting new customers. Still have questions or doubts? Don’t worry! Our customer support team is always ready to help via our live chat!